Get organized now to simplify your mortgage journey. Spring’s on the calendar, and even if…

How Much Do You Need for a Down Payment? 3 Common Myths Debunked

When it comes to buying a home, one of the biggest questions on buyers’ minds is: how much do I really need for a down payment? The answer isn’t as simple as a fixed percentage. The amount you’ll need depends on various factors, including the type of loan you’re pursuing, your financial situation, and your long-term goals. In this post, we’ll break down common myths about down payments and provide guidance for buyers across different financial backgrounds.

Myth #1: You Need 20% for a Down Payment to Buy a Home

One of the most persistent myths is that you need to put down 20% of the home’s purchase price to secure a mortgage. While this may have been the standard in years past, it’s no longer a hard-and-fast rule. Many buyers, particularly first-time homebuyers, qualify for loans with much lower down payment requirements.

For example, FHA loans allow buyers to put down as little as 3.5%, and VA loans, available to eligible veterans and service members, often require no down payment at all. Conventional loans also offer down payment options as low as 3% for qualified buyers.

Myth #2: A Smaller Down Payment Will Always Result in Higher Costs

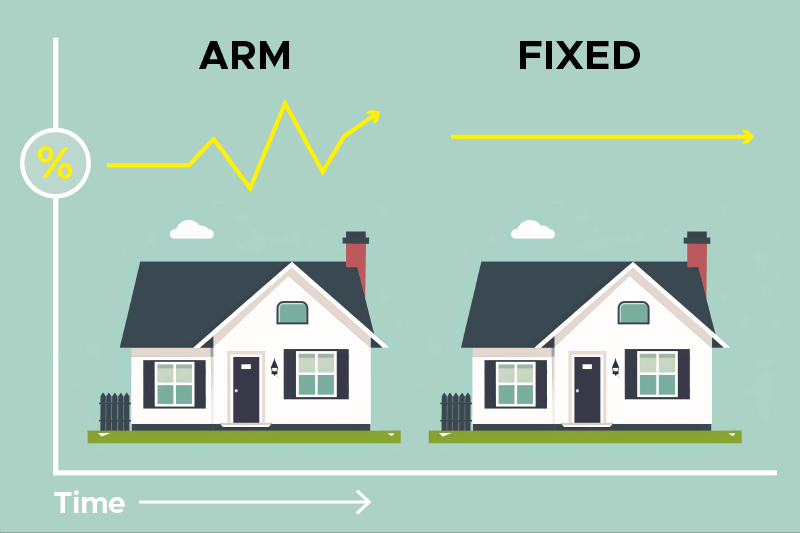

While it’s true that a smaller down payment can result in higher monthly payments and private mortgage insurance (PMI) requirements, this doesn’t automatically mean a bigger financial burden. In fact, for many buyers, waiting to save 20% might keep them from entering the market when home prices and interest rates are lower.

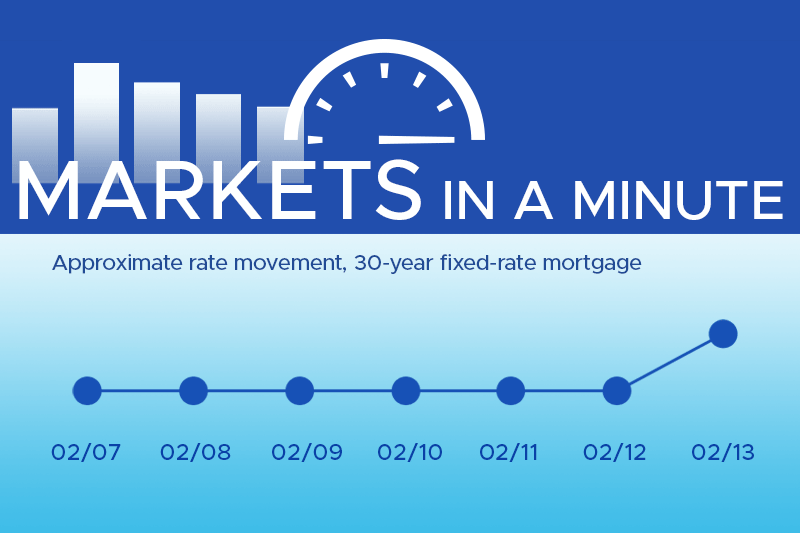

PMI can be an added cost, but it’s temporary—once you’ve built up 20% equity in your home, you can request to have it removed. Additionally, with interest rates fluctuating, it might make more sense to buy sooner with a smaller down payment than to delay and risk facing higher rates.

Myth #3: You Should Use All of Your Savings for a Down Payment

Another misconception is that you should funnel all of your savings into your down payment. While putting down a larger amount can reduce your monthly mortgage payments, it’s crucial to maintain financial flexibility. Homeownership often comes with unexpected costs—repairs, maintenance, and emergencies—so having a financial cushion is essential.

Lenders will also look favorably on buyers who have additional savings set aside. Known as “reserves,” these funds demonstrate that you have a safety net in case of financial difficulty. It’s recommended to keep three to six months’ worth of expenses in reserve after closing.

Options for Buyers with Different Financial Backgrounds

The good news is that there are plenty of down payment options, and many loans cater to buyers who don’t have large sums of cash saved up.

- First-Time Homebuyers: If you’re buying a home for the first time, there are numerous programs that can help reduce the financial burden. FHA loans are a popular choice, requiring as little as 3.5% down. Some state and local programs also offer down payment assistance to help first-time buyers get a foot in the door.

- Veterans and Active-Duty Service Members: VA loans offer a fantastic option for eligible veterans and active-duty military members, allowing them to purchase a home with 0% down. These loans often come with competitive interest rates and no PMI.

- Repeat Buyers: If you’ve owned a home before and are looking to purchase again, you have more flexibility in terms of the type of loan you can qualify for. Conventional loans with down payments as low as 3% are an option for buyers with strong credit and steady income.

Finding the Right Balance

Ultimately, the down payment you choose should align with your financial goals and comfort level. It’s about finding the right balance between making an affordable monthly payment and keeping enough savings for unexpected expenses. Whether you’re putting down 3%, 10%, or 20%, what matters most is that you feel secure in your homeownership journey.

Your Thompson Kane home loan expert is here to help you navigate these complexities and find the best mortgage options for your situation. Whether you’re buying a home or refinancing, contact us today to explore current rates and opportunities!