Thompson Kane's team is dedicated to helping our community track the ever-evolving landscape of the…

How Much Do You Need for a Down Payment on a House?

Are you planning to buy a home?

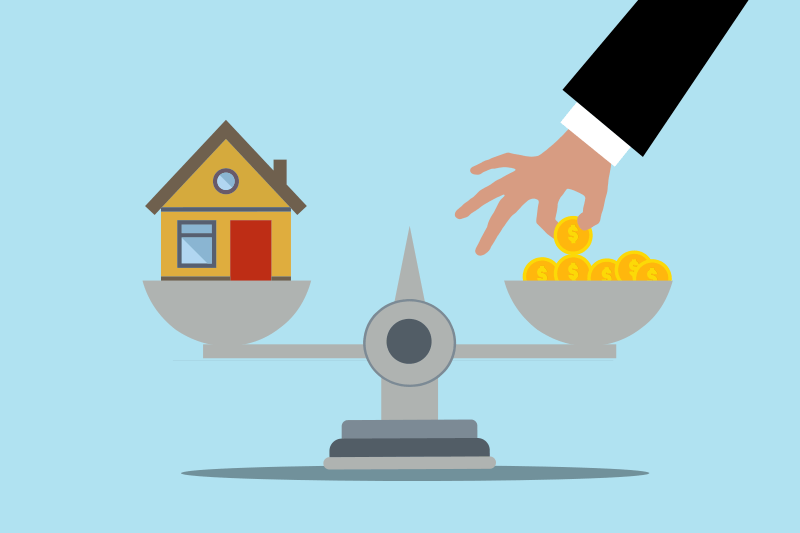

Here’s what you need to know about down payments if you’re in the market to purchase a home. You may be wondering how much you need to save before you can start your homeownership journey. Traditionally, 20% of the purchase price has been the norm. However, there are various mortgage options available today that require lower down payment amounts. Let’s take a closer look at these options and their specific requirements.

It’s important to note that the percentages mentioned below represent the portion of the overall purchase price of the home. Please keep in mind that these figures do not include closing costs, such as lawyer’s fees, inspections, and appraisals, which you should also budget for.

- 20% Down Payment: This is the standard down payment requirement for a traditional mortgage. It has long been considered the benchmark for homebuyers, as it offers certain advantages and typically helps secure better loan terms.

- 3.5-10% Down Payment: For those considering an FHA mortgage, the required down payment can range from 3.5% to 10%, depending on your credit score. It’s worth noting that there are income limits associated with this type of mortgage, so make sure to check the eligibility criteria.

- 0% Down Payment: Surprisingly, it is possible to purchase a home with no down payment. Both VA (Veterans Affairs) mortgages and USDA (United States Department of Agriculture) mortgages offer this option. However, there are specific requirements for each. The VA loan is available to individuals with previous or current military service and requires a property appraisal. On the other hand, the USDA loan has location requirements and income limits.

What if I want to put down a lower down payment than 20%?

Even if you can’t afford a 20% down payment, you still have options. You can choose to go with a traditional mortgage and put down a lower amount. However, keep in mind that in such cases, you will be required to pay for Private Mortgage Insurance (PMI). This is a monthly premium added to your mortgage payment. It’s important to understand that PMI protects the lender, not you, in the event that you default on the loan.

Can I put down a higher down payment?

Absolutely! In fact, you can put down more than 20% as a down payment. If you have the means, you can even pay for the entire home upfront and avoid the need for a mortgage altogether. By making a higher down payment, you can enjoy certain benefits. For example, your monthly mortgage payments will be lower, making it easier to manage your finances. Moreover, a higher down payment can increase your chances of qualifying for a mortgage, particularly if you have other factors that may affect your eligibility, such as a lower credit score or a limited income history. It’s important to consider the overall cost of homeownership, though, and keep some funds available for future repairs and maintenance.

Remember, when purchasing a home, your down payment is a crucial aspect to consider. Take the time to evaluate your financial situation and explore the various mortgage options available. With the right approach, you’ll be on your way to achieving your dream of homeownership.