At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

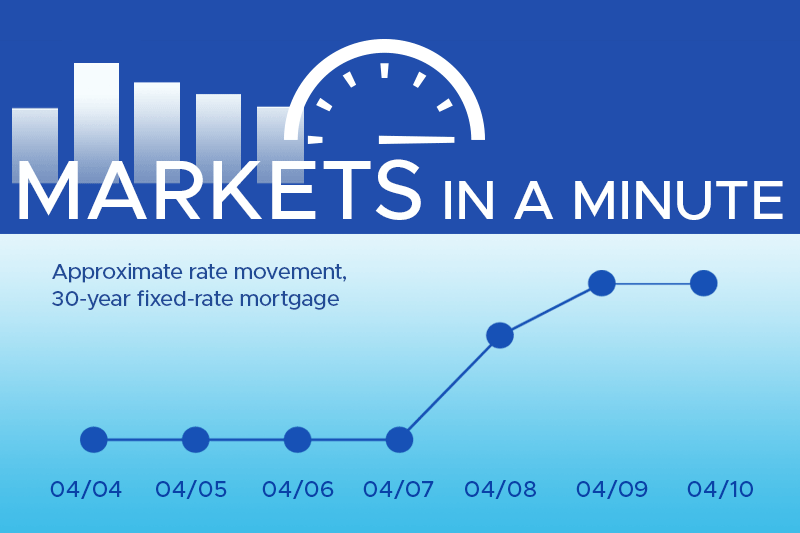

Markets in a Minute, Market Update July 10, 2023

This week’s housing and financial market update…

The Economy

- In June, consumer inflation reached a two-year low, sparking hope that the Federal Reserve might hold off on raising rates further, especially after the anticipated hike at the July meeting.

- There’s also encouraging news on the wholesale inflation front, as wholesale prices rose less than expected, outpacing consumer inflation’s decline.

- Labor Market Developments: In a surprising turn of events, new claims for unemployment benefits fell unexpectedly last week. Despite job growth slowing down, the labor market remains tight.

Housing Market Update

- The national housing market continues to show strength, with home prices reaching a record high in May, marking a 0.7% month-over-month increase, as reported by the Black Knight Home Price Index. Read story on CNBC.

- Mortgage Applications and Inventory: Mortgage applications have been on the rise for the third consecutive week, even amid limited inventory and interest rates exceeding 7%.

- Housing Inventory Update: The supply of available homes for sale continues to shrink, with weekly active listings dropping by 866 homes to a total of 464,889.

Summary of June Housing Starts: A Setback in New Home Construction

In June, the new home construction sector faced a setback, with an 8.0% month-over-month decline, reaching an annual rate of 1.43 million units, according to data from the U.S. Census Bureau. Starts for all privately owned homes experienced an 8.1% drop compared to June 2022, declining from 1.59 million in May.

Key Takeaways:

- Overall Housing Starts: June witnessed an 8.0% decline from the previous month and an 8.1% year-over-year decrease.

- Single-Family Homes: Starts for single-family homes dropped 7.0% in June.

- Permits for Single-Family Construction: While overall starts decreased, permits for new single-family construction rose by 2.2% over June.

- Single-Family Homes in June: June concluded with single-family starts down by 7.0% compared to May, resulting in an annual rate of 935,000 units.

Economists emphasize new construction as a solution to low housing inventory nationwide. After a remarkable 16% surge the previous month, June’s 8.0% decline came unexpectedly.

As we navigate these market conditions, understanding the driving factors behind the decline is crucial for devising effective strategies. Stay tuned for further updates as we closely observe the market’s performance at Thompson Kane. We remain committed to providing up-to-date insights and analysis for informed decisions in the real estate landscape.

The Last Word

“You were designed for accomplishment, engineered for success, and endowed with the seeds of greatness.”

–Zig Ziglar