At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

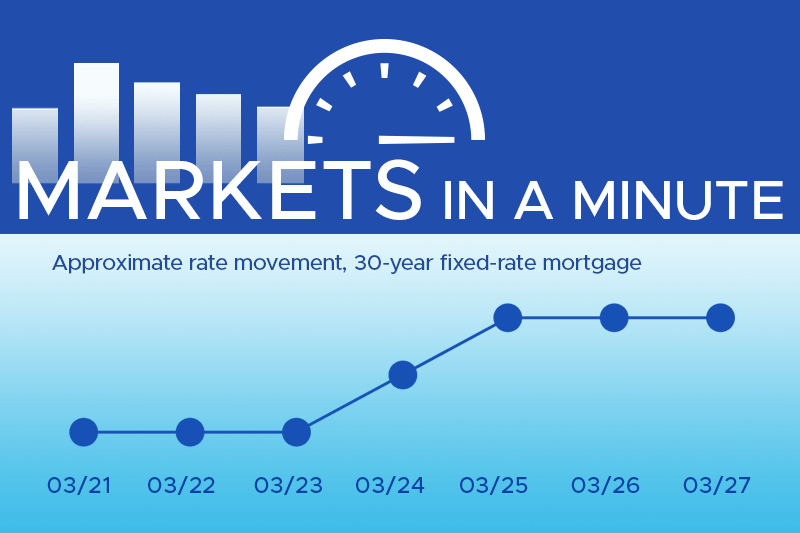

Markets in a Minute, Housing Market News, November 3, 2023

This week’s financial and housing market activity update…

The Economy

- The Federal Reserve Board announced this week that it will maintain the current policy interest rate and suggested that the recent run-up of long-term treasury yields could help stave off further rate increases. Chair Jerome Powell kept the future ambiguous. He stated that raising rates at the next Fed meeting is a possibility but that the hold on rate increases could continue if inflation doesn’t settle into the 2% target rate.

- Consumer confidence was down again last month in spite of a booming economy as inflation worries continue.

- Jobless claims increased for the sixth consecutive week, possibly indicating a cooling labor market. Despite this, job opening data revealed that layoffs are at a nine-month low.

Housing Market News

- ICE Mortgage Technology reported that home prices reached a new record in August for the fourth month in a row, with a 0.68% increase over July’s prices.

- The homeownership rate held steady at 66% in the 3rd quarter, according to the Census Bureau. The rate is 3.2% lower than its 2004 peak.

- The Census Bureau reported that the homeownership rate remained constant at 66% in the third quarter, 3.2% below its peak in 2004.

✅ Productivity tip: Prioritize Lead Generation. Consistently generate new leads by networking, using social media, attending local events, and creating a strong online presence. Building a steady pipeline of potential clients is crucial for long-term success in real estate sales.