At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Housing Market and Economic News Update: September 13, 2024

Thompson Kane is dedicated to helping our community stay on top of the ever-changing landscape of the housing market and the economy. Let’s dive into the most recent developments:

This Week’s Housing Market News

- Housing Inflation Update: The U.S. shelter inflation rate (rise in the average cost of housing) in August declined from its March 2023 peak of 8.2%. However, a 0.5% monthly increase was the largest since early 2024. Shelter costs, making up about 40% of core inflation, increased by 5.2% year-over-year in August.

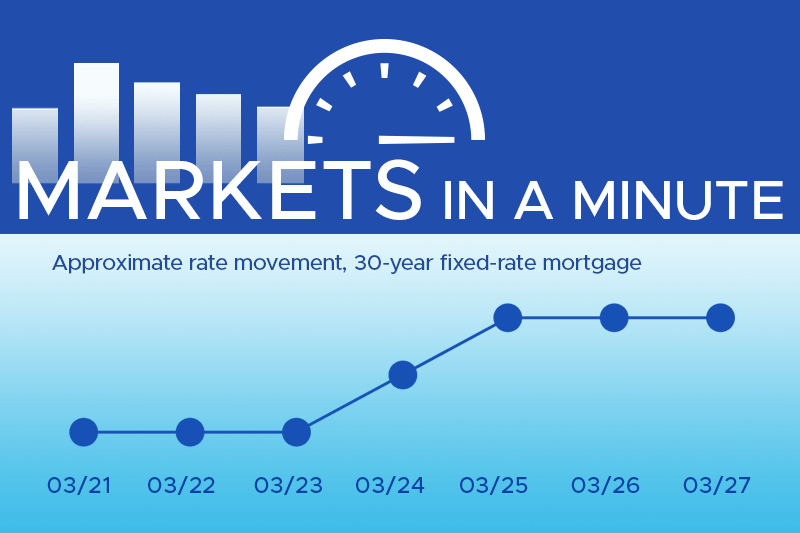

- Mortgage Rates and Demand: As interest rates dipped last week, overall mortgage demand rose by 1.4%, with purchase applications increasing by 2% and refinance activity up 1% over the same period.

- Equity Rises: Homeowners now hold over $32 trillion in home equity, a record high, with the average homeowner having $214K in equity.

This Week’s Economic Highlights

- Inflation: Inflation in August reached its lowest level since February 2021, paving the way for a potential policy rate reduction by the Federal Reserve.

- Jobs: Jobless claims slightly increased last week to 230K, but layoff rates remain low, signaling a cooling labor market.

- Wholesale Prices: Wholesale prices rose modestly by 0.2% in August, further suggesting that inflation is heading toward pre-pandemic levels.

Keeping you up-to-date with the constantly changing housing market

At Thompson Kane, we understand the importance of staying ahead in a rapidly changing market. Our goal is to equip you with the latest insights to help you make informed decisions. The right insight will help you confidently navigate your business and financial endeavors. For more frequent updates, follow the Thompson Kane Newsfeed and connect with us on Facebook for bi-weekly news and valuable content. Your success is our priority, and we’re here to keep you informed every step of the way.