At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Housing Market and Economic News Update: August 22, 2024

Thompson Kane is dedicated to helping our community stay on top of the ever-changing landscape of the housing market and the economy. Let’s dive into the most recent developments:

This Week’s Housing Market News

- Home Sales: According to Fannie Mae economists, the recent dip in mortgage rates is unlikely to boost home sales in the near future.

- Supply Increase: However, July saw a rebound in home sales, ending a 4-month decline, as supply increased by nearly 20% compared to last year. Despite this, the NAR reports that sales activity remains subdued.

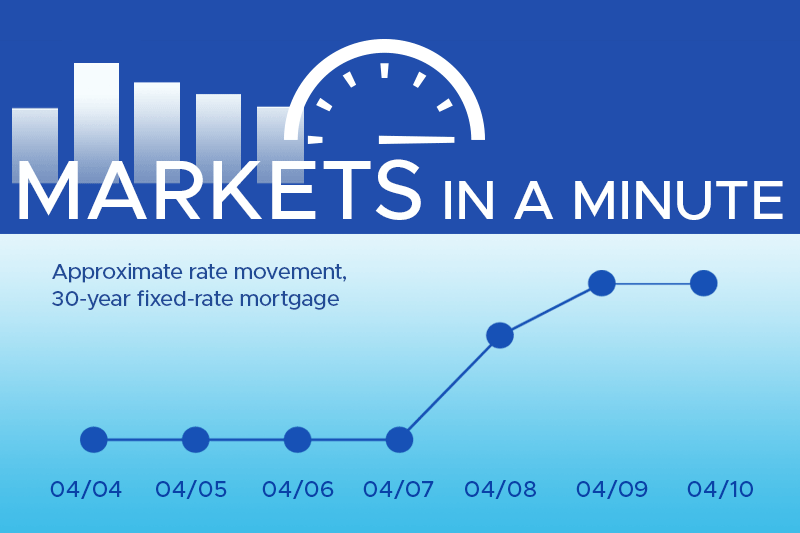

- Rate Predictions: Fannie Mae projects that mortgage rates will average 6.4% by the end of this year, with a further decline to 5.9% expected by the end of 2025.

This Week’s Economic Highlights

- Fed Interest Rate Cuts: The latest Fed meeting minutes reveal that most members support a policy rate cut at the upcoming meeting.

- Market Anticipation of Rate Cuts: Markets are already anticipating a September rate cut, which would mark the first reduction since the pandemic’s emergency measures.

- Employment: Last week’s unemployment applications showed a minimal increase, while the 4-week average dropped to its lowest point in a month, reducing volatility.

Keeping you up-to-date with the constantly changing housing market

At Thompson Kane, we understand the importance of staying ahead in a rapidly changing market. Our goal is to equip you with the latest insights to help you make informed decisions and confidently navigate your business and financial endeavors. For more frequent updates, follow the Thompson Kane Newsfeed and connect with us on Facebook for bi-weekly news and valuable content. Your success is our priority, and we’re here to keep you informed every step of the way.