At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

House Hunting in a Seller’s Market: Tips for Success

In today’s fast-paced market, house hunting in a seller’s market can feel like a race against the clock. Homes are moving quickly, multiple offers are common, and buyers often face tough competition. If you’re considering buying a home this spring, preparation is key—and that includes getting your financing lined up early. At Thompson Kane, our experienced loan officers are here to help you navigate the financial side of your home search and strengthen your buying position from day one.

In today’s fast-paced market, house hunting in a seller’s market can feel like a race against the clock. Homes are moving quickly, multiple offers are common, and buyers often face tough competition. If you’re considering buying a home this spring, preparation is key—and that includes getting your financing lined up early. At Thompson Kane, our experienced loan officers are here to help you navigate the financial side of your home search and strengthen your buying position from day one.

What Makes It a Seller’s Market?

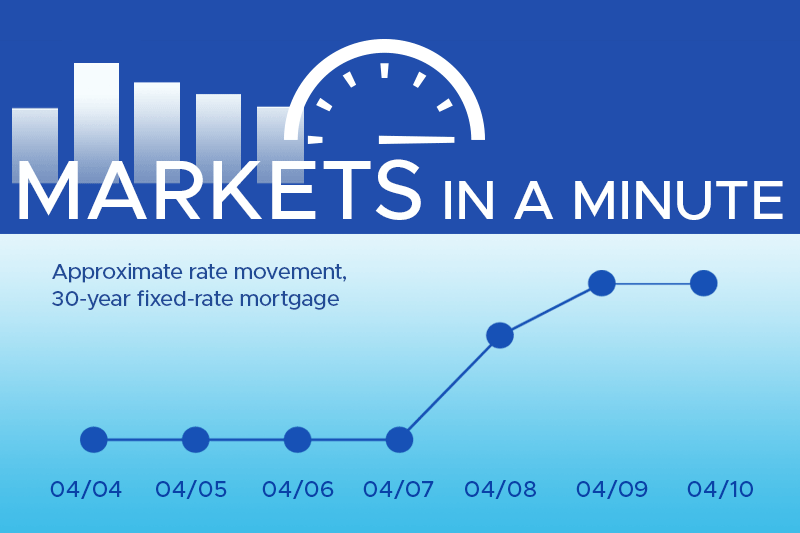

Simply put, a seller’s market happens when there are more buyers looking for homes than there are homes available. That’s exactly what we’re seeing this spring across many areas. Inventory remains tight, while demand is fueled by buyers eager to lock in a home before interest rates climb again. For buyers, this means acting fast—and being financially ready—is critical to landing your ideal home.

Get Pre-Approved to Gain an Edge

One of the most powerful moves you can make when house hunting in a seller’s market is securing pre-approval for your mortgage. Pre-approval shows sellers you’re serious and financially qualified. In competitive markets, many sellers won’t even consider offers without it. At Thompson Kane, our lending experts can walk you through the pre-approval process quickly, so you know exactly how much home you can afford—and so sellers know, too. In fact, many real estate agents prefer to work with buyers who are pre-approved because it makes every offer stronger.

Understand Your Budget—and Stick to It

It’s easy to get caught up in the pressure of bidding wars and market competition. However, one of the biggest mistakes buyers make when house hunting in a seller’s market is overextending themselves financially. Our loan officers can help you break down your potential monthly payments, property taxes, insurance, and any private mortgage insurance (PMI) that may apply. That way, you’re armed with knowledge—and ready to make smart financial decisions without regrets down the road.

Move Quickly, But Thoughtfully

Yes, speed matters in this market. Homes that are priced well and show well often sell within days. That’s why partnering with a trusted real estate agent is essential—they’ll help you move fast when the right home appears. At the same time, our Thompson Kane lending team is here to answer any questions you have about how the home’s price, condition, or location might impact your financing or long-term investment. We’re here to help you see the full financial picture, even when time is short.

Explore Loan Options That Fit the Market

Many buyers don’t realize they have more financing options than they think. If you’re house hunting in a competitive market, it’s worth exploring options like adjustable-rate mortgages (ARMs), bridge loans, or creative financing strategies that could give you added flexibility. Our Thompson Kane team specializes in helping buyers weigh these choices, ensuring your financing strategy supports your goals—not just today, but for years to come.

Ready to Start House Hunting? We’re Here to Help.

Navigating house hunting in a seller’s market takes strategy, speed, and a solid financial plan. At Thompson Kane, our experienced mortgage professionals are ready to support you every step of the way. Whether you have questions about pre-approval, budgeting, or choosing the right loan, we’re here to help you buy with confidence. Contact our lending team today to get started—and take the stress out of your home search.