At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Win the Spring Market: Financial Preparation to Secure Your Dream Home

Spring buyers face competition—here’s how to get financially prepared to act fast.

Spring is prime time for home buying, and financial preparation for house hunting is key to staying ahead of the competition. If you’re planning to purchase a home this season, getting financially ready in advance can give you a decisive advantage. At Thompson Kane, we specialize in helping homebuyers position themselves for success in a fast-moving market. Need guidance on your next steps? Contact our loan officers today to get ahead of the pack with a strong financial foundation.

Why Financial Readiness Gives You an Edge

In a competitive spring market, hesitation can cost you your dream home. Many buyers will be pre-approved, financially organized, and ready to make fast offers. To stand out, you need more than just a budget—you need a financial strategy. So, what can put you ahead when sellers are choosing between multiple offers? A strong credit profile, a well-planned down payment, and a clear understanding of your mortgage options!

Smart Financial Moves for Spring House Hunters

Effective financial preparation for house hunting means more than just saving money. It’s about being ready to act fast when the right home comes along. Use these key steps to strengthen your financial position before the home search begins:

1. Get Pre-Approved Early – A mortgage pre-approval shows sellers you’re a serious buyer with the financing to back it up. In today’s fast-paced market, many sellers won’t even consider offers from buyers who haven’t secured pre-approval. At Thompson Kane, we streamline this process to help you confidently shop within your price range.

2. Strengthen Your Credit Score – A higher credit score can mean lower interest rates and better loan terms, which translates to more home-buying power.

• Check your credit report for errors and address them now.

• Avoid opening new lines of credit or making large purchases that could impact your debt-to-income ratio.

• Make timely payments on all existing debts to keep your score strong.

3. Bolster Your Down Payment & Cash Reserves – More cash upfront can improve your loan terms and make your offer more attractive to sellers. If possible:

• Boost your savings by cutting unnecessary expenses.

• Explore down payment assistance programs that may be available to you.

• Ensure you have funds for closing costs and post-purchase expenses like inspections and moving.

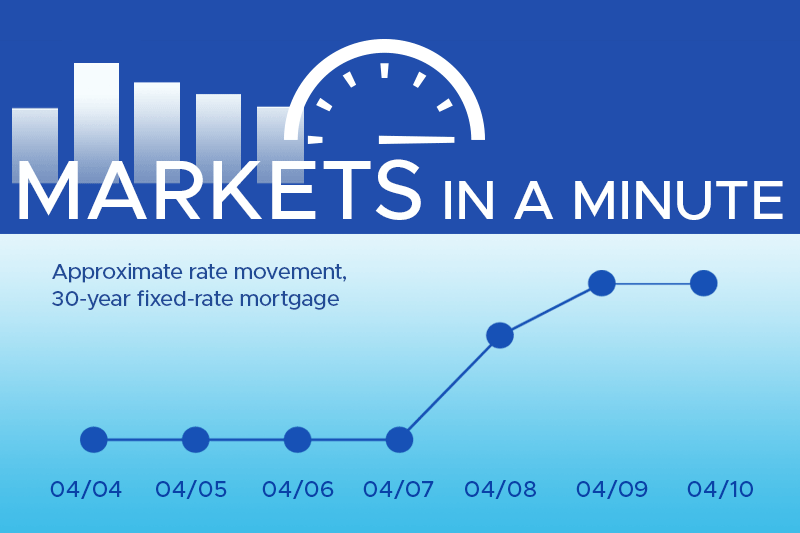

4. Know Your Loan Options & Market Conditions – Understanding your mortgage choices—fixed-rate, adjustable-rate, FHA, or VA loans—helps you make informed decisions quickly. Spring inventory moves fast. The last thing you want is to lose time debating financing options after finding a home you love.

Tip: Work with a loan officer who can explain how interest rates and loan programs align with your long-term financial goals.

5. Be Ready to Make a Strong Offer – In a multiple-offer situation, financial preparedness can give you a competitive edge. A strong offer isn’t just about the price — It’s also about how confident the seller feels in your ability to close the deal.

• Consider making a larger earnest money deposit to signal commitment.

• Have a pre-approval letter in hand from a trusted lender like Thompson Kane.

• Be flexible with closing timelines if it strengthens your offer’s appeal.

Seize the Spring Market Opportunity

The right financial preparation for house hunting helps you make strong offers and secure the best mortgage options. The time to prepare isn’t when you find the perfect home—it’s now. At Thompson Kane, our mortgage experts are here to guide you through every step. We will help you position yourself for success. Reach out today to get started!