As we look ahead to 2024, the world of outdoor living is set to experience…

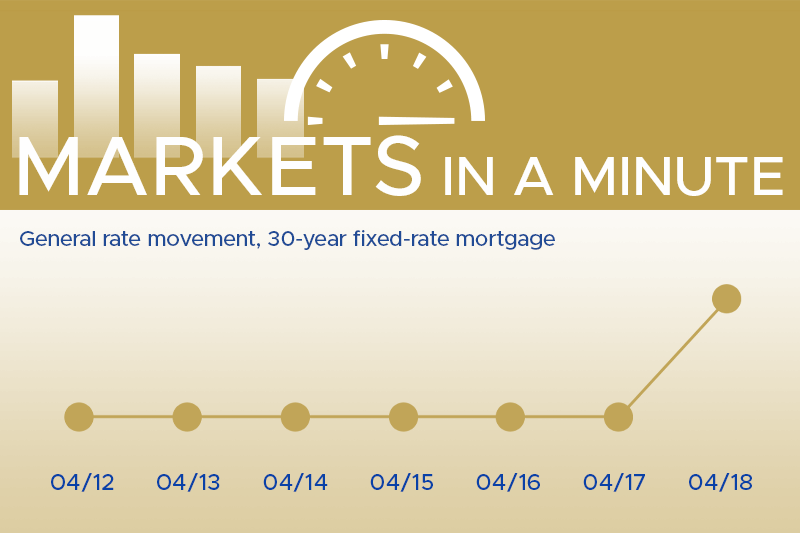

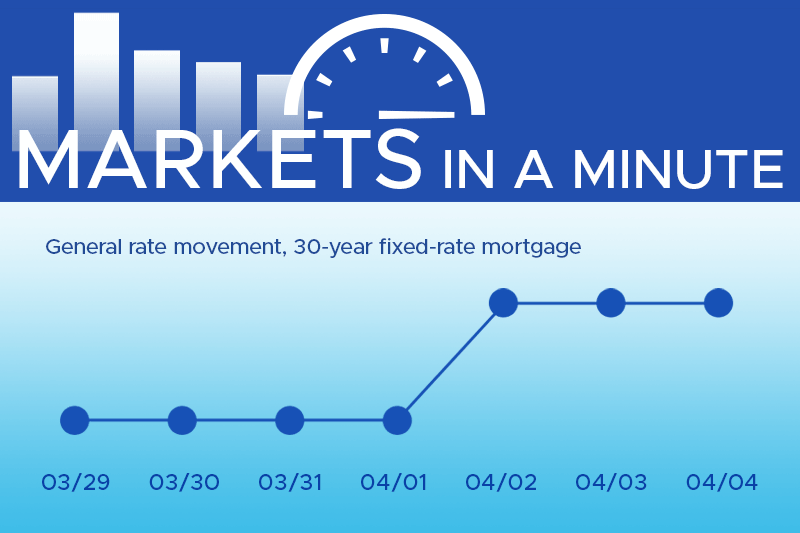

Housing Market and Economic News for April 18th, 2024

Welcome to our weekly roundup, where we bring you the latest housing market and economic news.

This Week’s Economic News

- In March, retail sales surged by 0.7%, surpassing expectations and marking the second consecutive monthly increase, highlighting the resilience of the economy.

- Despite efforts to lower inflation, progress has stalled. This has led Fed officials to indicate a likelihood of maintaining higher rates for an extended period this year.

- Jobless claims remained steady at 212K last week, underscoring the strength of the labor market with no signs of increasing layoffs.

Housing Market News

- Although single-family home starts dipped by 12.4% in March, they still boasted a 17.4% year-over-year increase.

- Builder sentiment remained unchanged in April, with mortgage rates nearing 7%, and first-quarter inflation data showing little improvement.

- Despite the higher rates, mortgage applications climbed for the second consecutive week, with purchase applications surging by 10% and refinance applications up by 3%.

Staying abreast of the latest developments in the economy and the housing market is crucial for both industry professionals and homeowners alike. By staying informed, professionals can better serve their clients by offering insightful guidance and strategies tailored to the current landscape. For homeowners and potential buyers, staying tuned in ensures they can make informed decisions, enabling them to plan for a healthy financial future amidst evolving market conditions. Call your Thompson Kane loan officer today if you have any questions regarding how today’s market conditions could inform your housing goals and financing strategies.