At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Understanding Adjustable-Rate Mortgages in 2025

Is an ARM a Good Fit for Your Financial Goals?

As you explore home financing options, you may have come across adjustable-rate mortgages (ARMs). With the housing market evolving and interest rate trends shifting, understanding how ARMs work in 2025 can help you determine whether this type of loan aligns with your financial plans. At Thompson Kane, we specialize in guiding homebuyers through these decisions, ensuring you get the best financing strategy for your future. Our loan officers are always available to answer your questions about adjustable-rate mortgages. They can help you to determine if an ARM is the right fit for your situation, or if another options is a better match.

What Is an Adjustable-Rate Mortgage (ARM)?

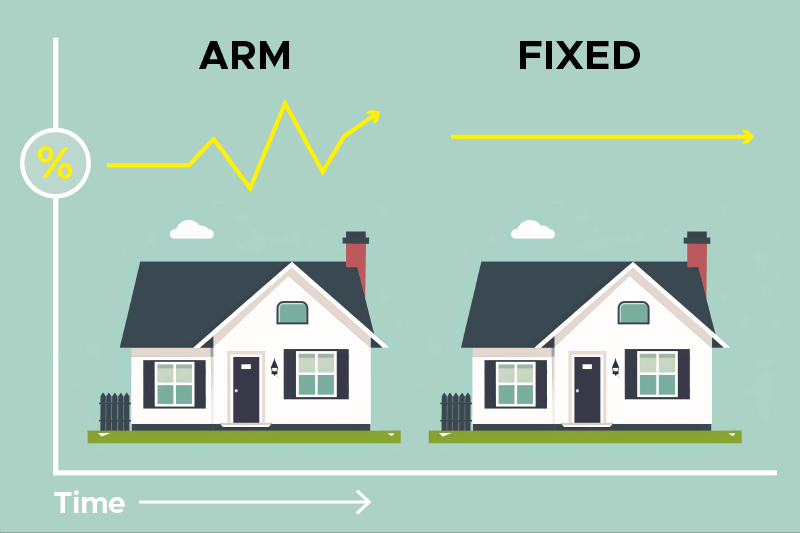

An adjustable-rate mortgage (ARM) is a home loan with an interest rate that changes over time. A fixed-rate mortgage keeps the same interest rate for the entire loan term. In contrast, an ARM begins with a lower fixed rate for a set period, usually 5, 7, or 10 years. After this period, the interest rate adjusts periodically based on market conditions.

How Do ARMs Work in 2025?

Adjustable-rate mortgages in 2025 function similarly to previous years, but borrowers should pay attention to key factors that influence how these loans adjust:

• Initial Fixed-Rate Period – This is the time when your interest rate remains unchanged. Common options include 5/1, 7/1, and 10/1 ARMs. The first number represents the fixed-rate period (in years). The second number represents how often the rate adjusts after the initial period (typically once per year).

• Index & Margin – After the fixed-rate period, the new rate is determined by an index (such as the SOFR or Treasury index) plus a lender-defined margin.

• Rate Caps – ARMs include caps that limit how much the interest rate can increase at each adjustment and over the life of the loan. This helps to protect borrowers from extreme fluctuations.

Are ARMs a Good Fit for Your Financial Goals?

Adjustable-rate mortgages can be beneficial in certain scenarios, such as:

• Short-Term Homeownership – If you plan to move or refinance within a few years, an ARM’s lower initial rate could provide significant savings.

• Lower Initial Payments – ARMs often start with lower monthly payments compared to fixed-rate mortgages, making homeownership more affordable in the early years.

• Falling Interest Rate Environment – If market trends indicate rates may decrease over time, an ARM could allow you to benefit from lower payments in the future.

However, ARMs also come with risks, particularly if interest rates rise significantly after the initial fixed period. That’s why it’s crucial to evaluate your long-term financial stability and consult with a Thompson Kane mortgage expert before making a decision.

Loan OfficersUnderstanding Today’s Market Trends

In 2025, interest rates continue to fluctuate, influenced by economic conditions, Federal Reserve policies, and inflation trends. While fixed-rate mortgages provide long-term predictability, ARMs offer flexibility for those who understand how to navigate market changes. At Thompson Kane, our lending professionals can provide insights into current market conditions and help you determine the best mortgage strategy based on your goals.

Talk to a Loan Expert About Your Mortgage Options

Choosing between a fixed-rate mortgage and an ARM requires careful consideration of your financial situation and future plans. If you’re considering an adjustable-rate mortgage in 2025, our team at Thompson Kane is here to help. Contact one of our experienced loan officers today to discuss your options. We’ll help you find the best loan structure for your home purchase.