At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Mortgage Lender Insights: How the 2025 Housing Market Forecast Impacts Borrowers

The housing market is always shifting, and 2025 is no exception. At Thompson Kane & Company, we take pride in helping our clients navigate these changes with confidence. Our experienced loan officers are here to provide expert guidance tailored to your unique situation. Whether you’re a first-time homebuyer or looking to refinance, understanding the 2025 housing market forecast can empower you to make informed decisions. Here, we explore key trends shaping the market and what they mean for borrowers.

2025 Housing Market Overview

The 2025 housing market is expected to remain challenging for many, with affordability constraints continuing to influence buyer behavior. Economists predict mortgage rates will average above 6% throughout the year, maintaining the “lock-in effect,” where current homeowners with lower rates are reluctant to sell. Existing home sales are projected to improve slightly but remain near multi-decade lows, while new home sales will remain a bright spot in areas with robust construction, such as the Sun Belt.

Affordability challenges persist as home prices are expected to grow at a more moderate 3.6% pace—a slowdown compared to recent years. While this deceleration is welcome news, it’s tempered by high borrowing costs, property taxes, and insurance rates, all of which strain budgets. These conditions call for careful financial planning, and that’s where the expertise of Thompson Kane’s loan officers can make a significant difference.

Key Factors Driving the 2025 Market

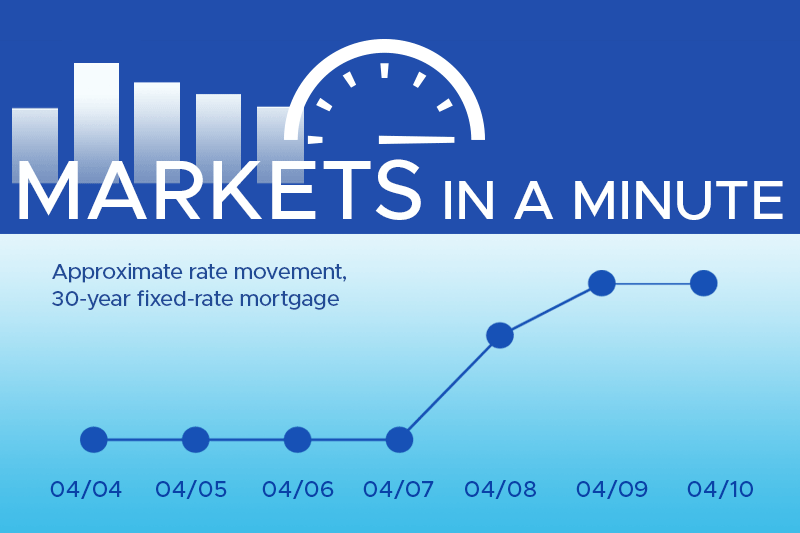

Mortgage Rates and Volatility

Economists anticipate 2025 will bring “bumpy” mortgage rates, ranging between 5.75% and 7.25%. While some relief could come if inflation cools, geopolitical uncertainties and federal economic policies may keep rates elevated. Borrowers should be prepared for fluctuations, and those who act swiftly during rate dips could secure more favorable terms. If you’re considering buying or refinancing, staying in close contact with your loan officer is essential to timing your move.

Regional Trends and Inventory Dynamics

The housing market will remain highly localized. Regions like the Sun Belt and Mountain West, where new construction has been strong, are poised for better activity. In contrast, supply-constrained areas like the Northeast may continue to see slow sales growth. Inventory improvements are expected but won’t fully address the deficit created over the past few years.

For buyers, this means opportunities may vary significantly depending on location. Working with a local Thompson Kane mortgage expert can provide valuable insight into your specific market conditions..

Affordability Challenges

While nominal wage growth may outpace home price appreciation for the first time in over a decade, this improvement is gradual. Many households still face difficulties saving for down payments or meeting monthly mortgage obligations. High insurance premiums and property taxes compound these issues, making it critical to evaluate the total cost of homeownership.

At Thompson Kane, we’re here to help you understand these financial components and explore loan options that align with your goals.

How Borrowers Can Prepare

Stay Informed and Flexible

Monitoring market trends can help you identify opportunities. For instance, a brief dip in mortgage rates might make refinancing or buying more advantageous. Consider consulting your loan officer regularly to discuss your options and understand how market changes impact your plans.

Focus on Financial Readiness

While market conditions are beyond your control, strengthening your financial position is always beneficial. Improving your credit score, reducing debt, and saving for a larger down payment can increase your borrowing power and make you more resilient to market fluctuations.

Think Long-Term

Even in a challenging market, homeownership remains a valuable investment over time. By focusing on properties within your budget and securing a loan with terms that suit your financial situation, you can build equity and stability. Our team at Thompson Kane can guide you through loan options tailored to your long-term goals.

Partner with Thompson Kane for Expert Guidance

The 2025 housing market presents unique challenges and opportunities for borrowers. With the right strategies and expert support, you can navigate this environment with confidence. Thompson Kane & Company’s loan officers are ready to assist you in making informed decisions about your mortgage, helping you achieve your homeownership dreams.

Don’t let market complexities deter you. Reach out to us today to discuss your goals and explore the options available to you. We’re here to make the home loan process as smooth and rewarding as possible.

Disclosure: This blog is for informational purposes only and does not constitute financial or legal advice. Consult a qualified financial advisor or lending professional for guidance on your unique situation. All loans are subject to approval and applicable terms.