At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

Housing Market News, September 21, 2023

This week’s financial and housing market activity update…

Economic Update

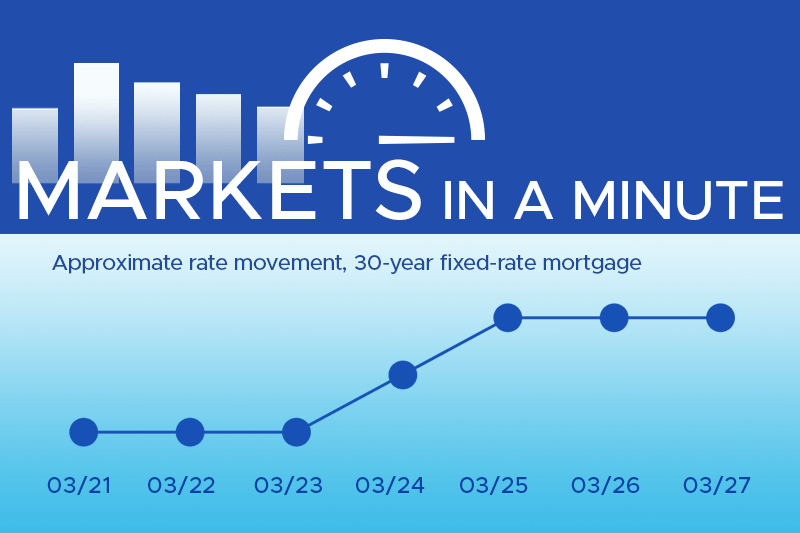

- The Federal Reserve announced this week that it will maintain current interest rates without any changes this month. Chair Jerome Powell announced that another rate hike is likely later in 2023. In addition, Powell suggested there would likely be fewer rate cuts in 2024 than previously anticipated. USA Today reports many economists expect that rates will be held at the current 5.25%-5.5% through the remainder of the year. However, expectations are mixed as data suggests more rate hike could be necessary as long as stubborn inflation remains elevated. Yesterday’s announcement marked only the second time the Fed did not raise rates since it began to do so in March, 2022.

- Weekly jobless claims fell by 20,000 to 201,000 last week, marking the lowest level seen since January [Reuters]. This decline serves as a positive indicator for the overall health of the labor market.

- The average interest rate on credit cards and the total U.S. credit card debt reached unprecedented highs this summer. However, credit card debt in relation to net income is below the average for the past 20 years [U.S. Chamber of Commerce]. Consumers are using credit cards to sustain routine spending while their income hasn’t kep pace with inflation. That dynamic has consumers currently spending less on high-cost items.

Housing Market News

- The real estate market has witnessed the impact of rising mortgage rates, which has led to a decline in homebuilder confidence. This decline has brought homebuilder confidence to its lowest point since April. This trend is primarily attributed to more potential buyers opting to postpone their purchases.

- Housing starts, an important metric in the housing industry, have seen a decline, reaching the lowest level since 2020. However, an increase in building permits suggests a potential rebound in the near future.

- Sales of existing homes recently reached a 7-month low. A key factor contributing to this trend is the persistently low inventory levels, which have driven up property values and elevated the median selling price to $407,100.