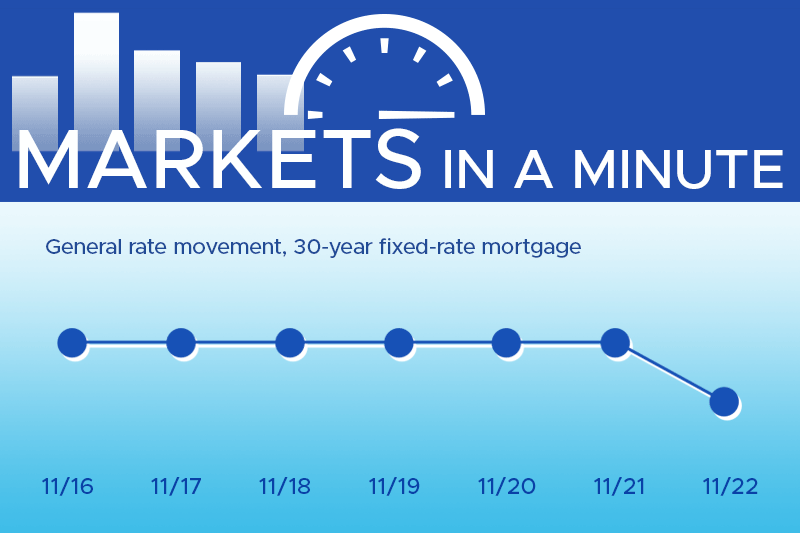

Markets in a Minute, Housing Market News, November 27, 2023

This week’s financial and housing market activity update… The Economy In October, the durable goods orders experienced a sharper decline than anticipated, influenced by diminished demand for auto parts due to the UAW strikes. Despite lower than expected durable goods…