At Thompson Kane, we stay ahead of shifting market trends so you don’t have to.…

10 Reasons Now Might Be the Right Time to Buy a Home

With summer ’24 underway, many potential homebuyers are feeling discouraged by high interest rates and elevated home prices. It’s natural to consider waiting for more favorable conditions. However, delaying your home purchase could potentially cost you more in the long run. Let’s explore why now might still be the right time to buy a home, despite current market challenges.

Here are 10 key considerations for anyone trying to decide if today is the right time to buy a home.

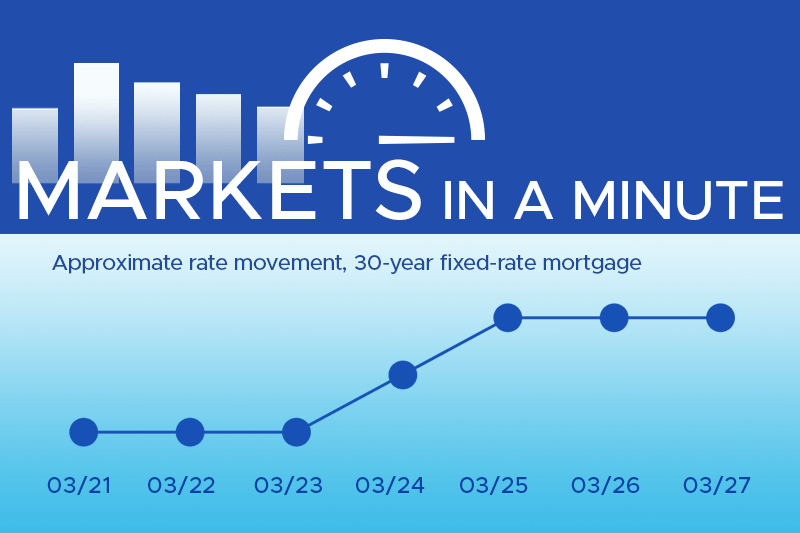

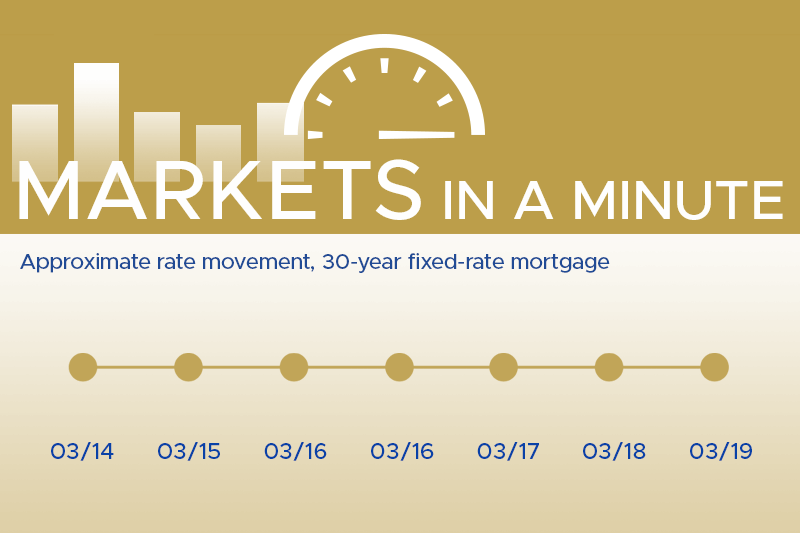

1. The Unpredictability of Interest Rates

While interest rates are currently high, there’s no guarantee they’ll decrease significantly in the near future. In fact, some economists predict rates could remain elevated throughout 2024 and potentially into 2025. Waiting for lower rates is a gamble that might not pay off.

2. The Continuous Rise of Home Prices

Home prices have consistently trended upward over time. Waiting to buy could mean paying a higher price for the same home in the future. Even with higher interest rates, the long-term appreciation of real estate often outweighs the short-term costs of financing. Your Thompson Kane mortgage expert and your local real estate agent can help you assess how appreciation might inform timing in your home buying journey.

3. The Power of Building Equity

Every month you rent is a month you’re not building equity in a home. By purchasing now, you can start building wealth through homeownership immediately. While the initial costs might be higher due to current rates, the equity you build over time can provide significant financial benefit.

4. Potential for Refinancing

If you buy now and rates decrease in the future, you may have the opportunity to refinance at a lower rate. This strategy allows you to enter the market now while leaving room for improvement in your loan terms later.

5. Tax Benefits of Homeownership

Owning a home often comes with tax advantages, such as the ability to deduct mortgage interest and property taxes. These benefits can help offset the higher costs associated with current interest rates.

6. Rent vs. Buy Calculations

Despite high interest rates, buying might still be more cost-effective than renting in many areas. Use a rent vs. buy calculator to compare the costs in your specific situation. Remember to factor in potential rent increases over time.

7. The Value of Stability

Homeownership provides stability and control over your living situation. In a time of rising rents, locking in your housing costs through a fixed-rate mortgage can provide peace of mind and better financial planning.

8. Market Timing is Difficult

Trying to time the real estate market perfectly is challenging even for experts. The best time to buy a home is when you’re financially ready and find a property that meets your needs. Waiting for perfect market conditions often leads to missed opportunities. Your Thompson Kane loan officer takes your best interests to heart, helping you determine whether the time is right, if you are financially prepared to buy, and how much house you can afford.

9. The Cost of Inaction

Consider the potential cost of not acting. If both home prices and interest rates rise, you could be priced out of the market or face significantly higher costs in the future.

10. Current Market Opportunities

While inventory is low, there may be less competition in the current market. This could lead to opportunities for negotiation or the chance to buy a property that might be out of reach in a more competitive market.

Conclusion

While current market conditions present challenges, the decision to buy a home should be based on your personal financial situation and long-term goals. The cost of waiting could potentially outweigh the benefits when considering factors like building equity, tax advantages, and the unpredictability of future market conditions.

If you’re financially prepared and find a home that meets your needs, now might be the right time to take the leap into homeownership. Remember, a home is not just a financial investment – it’s a place to build your life and create memories.

Be wise. Consult with the Thompson Kane mortgage team, your financial advisor, and real estate professionals who can provide personalized advice based on your specific circumstances and the latest market data.